We get asked a lot of questions about coverage and options. One question that sticks out is the difference between two settlement options.

There is a big difference between Actual Cash Value (ACV) and Replacement Cost Value (RCV) and not understanding the difference can cost you a bundle when you turn in a claim.

For this post I will use your home as an example.

Let’s pretend a hailstorm tore though Great Bend and it completely destroyed your roof. You had a contractor give you an estimate to replace the shingles and the estimate is $12,000.

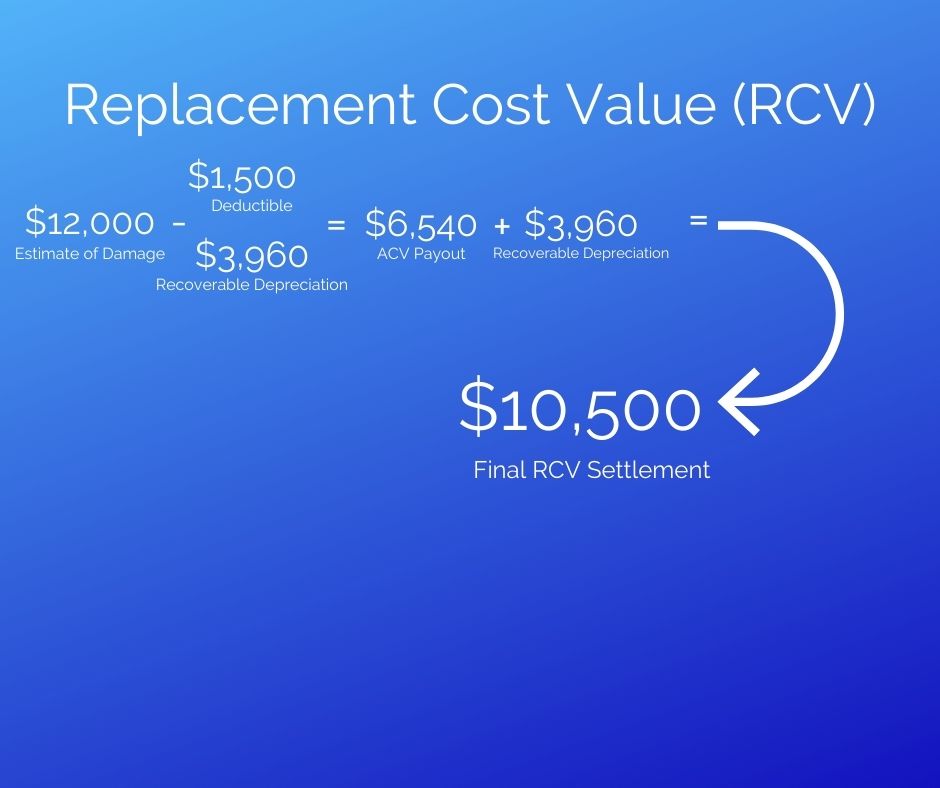

If you have Replacement Cost Value on your home your settlement from the insurance carrier would look like this:

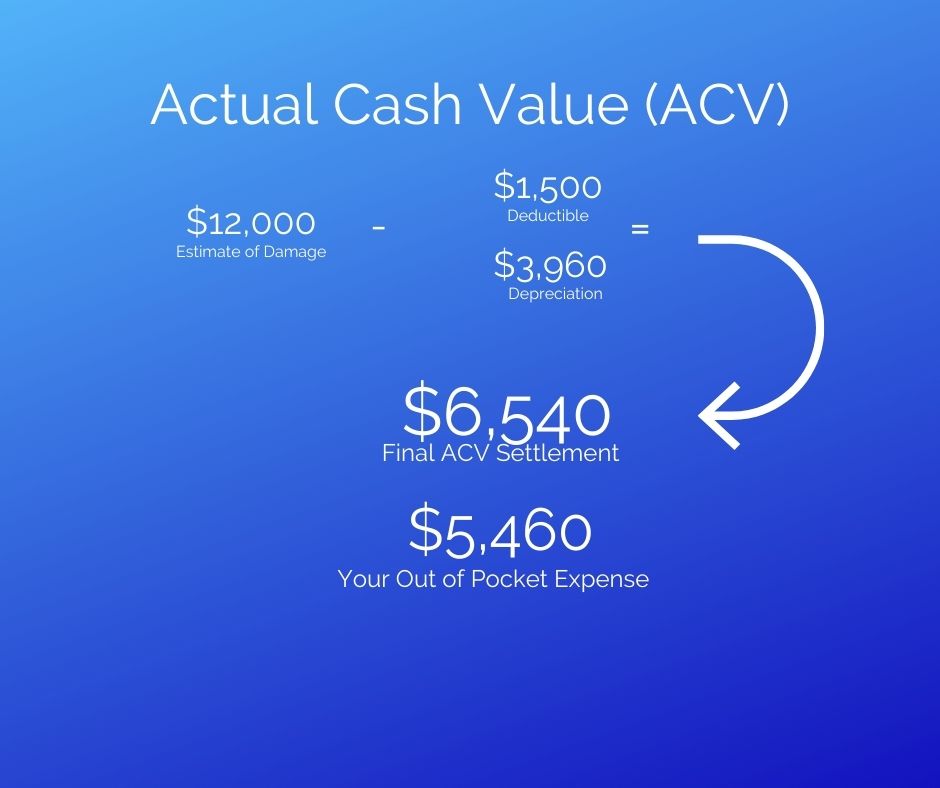

If you have Actual Cash Value on your home your settlement from the insurance carrier would look like this:

There is a significant difference in the settlement amount.

If you’re not sure which settlement option you have, it is time to look for an insurance professional who cares. We take the time to go through not only the settlement options, but the many nuances of each carrier to make sure you know what to expect when you need to file a claim.